by Dennis Crouch

Today’s decision in Cap Export, LLC v. Zinus, Inc., 21-2159 (Fed. Cir. 2022) (non-precedential) offers some insight into the difficulty of proving an anticipation case with something other than a prior patent or printed publication. Cap Export particularly focuses on a prior sale. The problem is that the item sold way-back-when typically no longer exists in its original form. And, although you might have product manuals, those documents themselves are not on-sale prior art. They may still be admissible to help show what the prior art looked like, but only as a proxy for the real thing.

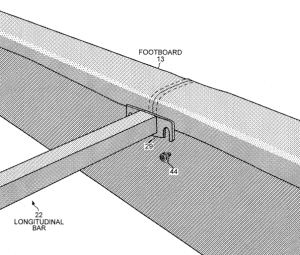

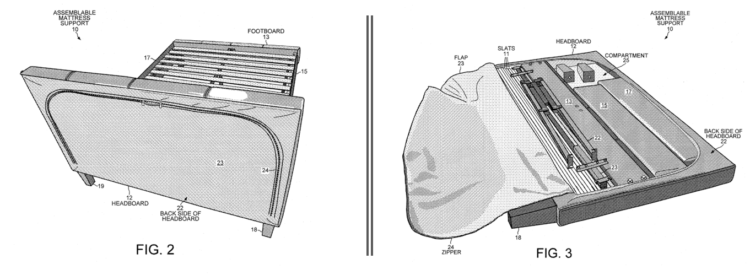

Zinus’ U.S. Patent No. 8,931,123 covers a bed-in-a-box system. All the parts for the bed frame fit neatly within the headboard. A zipper on the backside allows the purchaser to unpack them at home for assembly. Zinus did not invent this general concept, but rather offered an improvement with various limitations regarding how the parts are packaged and then connect together on assembly. The particular claim limitation at issue requires a connector on a longitudinal bar (running down the center of the bed); that is configured to attach to a connector on the footboard. This connection is shown in the image from the patent below.

If the instructions were prior art, they would clearly be anticipating. But the on sale bar does not relate to sales of instructions, but rather sales of the embodiment itself. Zinus presented two arguments as to why the instructions differ from the product sent. First, the instructions indicate that they are for a different “Fusion” bed rather than the “Mersin” bed. Second, the actual photo of the product from the inspection report appears to potentially show a different connection mechanism. I have included the photo below, and you cannot really tell how the longitudinal board is connecting with the base. Zinus expert suggest that it might be a hole/slot in the base (a non-infringing alternative) rather than each party having their own ‘connectors.’

Zinus provided declarations of potential witness testimony in support of the hole/slot theory, and Cap Export responded with accusations that those were “inadmissible sham declarations.” R.56 permits a district court to end a case on summary judgment prior to trial, but only in situations where the moving party “shows that there is no genuine dispute as to any material fact and the movant is entitled to judgment as a matter of law.” Fed. R. Civ. P. 56(a). At times, courts will rephrase the standard as stating: summary judgment is appropriate if “no reasonable jury” could decide the case otherwise. The fact-law divide is relevant to this issue as well — juries decide the facts; why judges ordinarily decide the law. And on this point, the Federal Circuit has repeatedly held that anticipation is a question of fact. After considering the evidence presented, the district court sided with the accused infringer on summary judgment. On appeal though, the Federal Circuit has vacated that determination–finding ongoing factual disputes.

Looking at the particular dispute, the appellate court found plenty of genuine disputes: “whether the Fusion bed and Mersin bed are the same structurally, whether the Fusion instructions describe the structure of the as-sold Mersin bed, and what exactly the ambiguous photo of the Mersin bed depicts. Accordingly, summary judgment was improperly granted.”

The court went on to particularly find that the district court had erred by making factual inferences in the movant’s favor. In particular, the district court had concluded that the Fusion/Mersin beds were the same and ignored the contrary declarations from Zinus. “Taking the record as whole, some evidence supports a conclusion that the Fusion assembly instructions apply to the Mersin bed and some detracts from that conclusion.”

The court also found the issues here material since the challenger’s anticipation case relies upon the Fusion instruction manual to provide that the Mersin bed anticipates.

Should a jury agree with non-movant Zinus and find that the Fusion assembly instructions do not apply to the Mersin bed, Cap Export would be left with the photograph of the Mersin bed as the only evidence with which to prove that the on-sale Mersin bed anticipates the ’123 patent claims. But what exactly that photograph shows is also a disputed factual question for the jury to consider.

Slip Op.

= = =

Anyone practicing in this area knows that the Federal Circuit has lots of quirks regarding the fact/law divide. Any given issue might be a question of fact; a question of law; a mixed question of fact and law; a question of law based upon underlying conclusions of fact; etc. The particular fact/law framework will then determine judicial role on issues like summary judgment as well as the standard of review on appeal.

As I mentioned above, anticipation is a question of fact. Telemac Cellular Corp. v. Topp Telecom, Inc., 247 F.3d 1316 (Fed. Cir. 2001). But, whether a patent is invalid under the on-sale bar is a question of law based on underlying fact findings. Meds. Co. v. Hospira, Inc., 827 F.3d 1363 (Fed. Cir. 2016). In some ways, these two sentences seem in tension.

= = =

The decision here is authored by Judge Stoll and joined by Judges Dyk and Taranto. Matthew Wolf led the winning team from Arnold & Porter representing Zinus. David Beitchman (Beitchman & Zekian) for Cap Export.

Re the “why was 103 not argued” questions: This is a patent case that has not yet gone to trial. As noted above, below, and in many prior discussions as to why IPRS and 12(b)6 101 unpatentable subject matter motions are so popular, it is very difficult to get summary judgment on that basis. It probably was argued in the defendant’s answer, but to actually win on 103 requires a very expensive full trial on that and all other possible issues.

Not following Paul, as the 103 comment is not to your “finally win” state but instead is geared to the current status and posture of the case.

If indeed as you suppose “was probably argued,” then I would expect the write up here to reflect that, and no such reflection is in evidence.

Bros, stocks are low, getting into super buy territory.

So I made Ez roundup.

The basics (6, I don’t know anything about stocks, buying ownership of companies, wut buy long term?):

VTI, VOO, MGK (or the equivalent with your institution just call them and say buy the equivalent they can probably help you).

All low, good long term 10+ year buys. If they go any lower it’s super buy time.

Ez play for beginners, 90% of your portfolio contribs starts with the above.

Ez stocks (all somewhat risky, no more than 10% of beginners portfolio ez stuff):

JPM (decent buy, can wait a tiny bit, but getting super low, still good company w decent cash payouts also)

NVDA (I say wait for another 20-30% off, around 90$, but if the crypto market surges this will surge again with it)

AMZN (Decent buy)

TSLA (decent buy, has another 10% drop it’s a strong buy)

AAPL (decent buy, obv if another 10% drop its strong buy)

Basic high dividend plays (monthly/quarterly/yearly cash payouts for new people). Some will tend to eat themselves, but should see 9% or so annual total return in dividend form.

RC (strong buy, looking at 9-14% cash per year, and it’s low)

LUMN (med buy, getting better, 10-12% cash per year, and it is currently low, tho could go lower, still long term good performer)

PMT (strong strong buy, 10-13% cash per year, currently low)

NLY (med buy, 9% total returns overall, with strong cash payout, will do reverse stock split soon which is not bad for this type of REIT, this is super low could hold just till it does the reverse split and then wait till it doubles to sell likely in but a few years as it is so low)

Ez play, get 1/4 of each, just max the 6k$ for this year in your ROTH account specifically.

But 6, how do I get my tasty dividends (cash payouts) tax free (after already having paid taxes on my salary)? You set up a ROTH IRA and put them in there (6k$ investment contribution cap per year, but your dividends are then tax free forever, even withdrawing them, just ask your institution to set you up one or do it online yourself). In around 10 years you will have 10k+ tax free rollin in np every year, always reinvest the cash payouts till you need, or keep as dry powder for diversification.

You like to make literal space plays for funsies and your great grandkids?

RKLB, ASTR, SPCE (all space companies, all super low, great grandkids will be well off).

Sheesh.

With the aggregate expenditures long ago exceeding the value of any connector advance over the prior art, why have the parties continued this fight?

And as anon asks, what about 103?

Reversal of District Court summary judgements based on prior art due to “disputed facts” is common. Also, this decision says this case has already been through three appeals on other issues [yet never getting to trial!]. [C.D.CA, so I am not surprised] Both leading to asking why a prompt 103 IPR based on patents or publication prior art of bedframe fastening structures would not have been a great deal faster, cheaper and more effective? Even if such an IPR was not fully successful, some alleged prior product prior art could still be available for proof at trial, because, if not corresponding to a patent or publication, it is not subject to IPR estoppel.

IPR’s can’t touch on-sale bar issues….which is the proper rule b/c they can’t compel witnesses, etc.

Wondering if the accused infringer did not also advance a case of obviousness (and if not, why not)…

Comments are closed.